Cost is one of the most significant barriers to education for American students. Although most students receive financial aid, few receive enough to complete a full degree program.

Higher education institutions can boost student retention and response rates by better supporting students facing financial uncertainty — and identifying which students are most in need is a critical component of those strategies.

Intelligent software with predictive analytics capabilities can help your institution provide struggling students with the resources they need to stay on track.

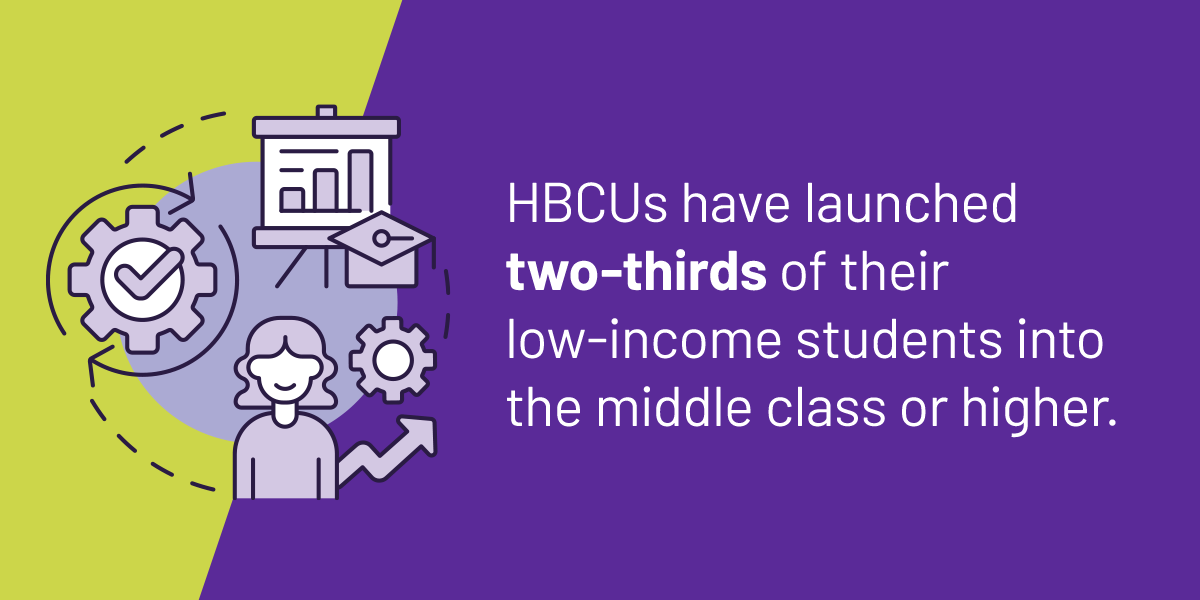

Education pays. Research has shown a strong correlation, known as the “college wage premium,” between education and income levels. While the wage premium varies between states, the overall trend is consistent nationwide.

Earnings data from the Bureau of Labor Statistics (BLS) revealed that people who held two- and four-year degrees made more on average than those without degrees. Similarly, well-educated people were more likely to maintain steady employment.

The college wage premium matters. While 62% of high school graduates enrolled in college in 2022, graduation rates have not kept pace. That same year, 37.7% of adults aged 25 and older had achieved a bachelor’s degree or higher. While racial gaps in degree completion have narrowed, they have not narrowed enough, with 20.9% of Hispanic adults, 27.6% of Black adults, 41.8% of non-Hispanic White adults, and 59.3% of Asian adults having completed a bachelor’s degree.

Students who come from historically disenfranchised groups — low-income, Black, Latinx, and academically at-risk students — continue to struggle to achieve college success. Financial obstacles only exacerbate this problem by prohibiting academic success.

Students have assistance at their disposal. Federal financial aid and student loans allow students from economically disadvantaged families to continue their academic journeys beyond high school graduation. However, higher learning institutions face challenges when providing student assistance from enrollment to completion.

Students seeking federal financial aid to help pay for college must first fill out the Free Application for Federal Student Aid (FAFSA) form. The FAFSA is integral to the U.S. Department of Education’s Federal Student Aid decision to distribute more than $102.51 billion in federal aid annually.

States and universities use the FAFSA to make decisions regarding financial aid awards. Unfortunately, many students find the form too complex and confusing, so they choose not to complete it. This low completion rate leaves billions of dollars in federal aid unawarded each year.

To ease the burden of applying for aid, Congress passed the FAFSA Simplification Act (FSA) in 2020. This act, which goes into effect in July 2024, made significant amendments to the original FAFSA that will streamline the form and expand access to federal aid for students in various underserved populations.

After submitting their FAFSA applications, around 25% of students receive a request from the Department of Education to provide additional information each year for audit through a verification process. This audit serves as confirmation that the information on the application form is accurate.

Students who get flagged for verification are often from underrepresented and minority groups. Additionally, flagging and verification is about 60% more likely for students who qualify for federal need-based Pell Grants — numbers that are even more concerning when you consider that nearly 25% of students eligible for Pell Grants fail to complete this process.

The current audit process requires students in the most need of financial aid to go to great lengths to prove their eligibility. Community colleges provide the strongest evidence of this additional burden. Community colleges typically serve a disproportionately high number of Pell Grant recipients, where only 30% of Pell-eligible students graduate.

When students lack easy access to financial aid programs, they may feel the need to drop out of college before receiving their degree. Out of all American undergraduates, about 40% of them will drop out — and about 30% of those students will have done so before the beginning of their sophomore year.

Failing to finish college leaves thousands of students with high amounts of debt. And when college dropouts make 35% less income on average than people who hold a bachelor’s degree, it’s clear that the majority of these students will have a challenging time paying off their debts.

Students with dual enrollment — concurrent enrollment in two separate educational institutions — face additional hurdles in accessing financial aid. These students are rarely eligible for federal financial aid, as most of them are high school students who are also taking college courses.

Plus, college credits earned through dual enrollment can affect how long a student can receive state and federal financial aid, as well as the maximum financial aid packages students can receive from federal student loan programs. So although dual enrollment can give students a head start in their degree program, missing out on much-needed financial aid could impact their ability to finish.

The onus is on higher education institutions to shrink the equity gap in education by:

The first step in helping students navigate financial obstacles is identifying low-income, high-risk students who could benefit from financial aid consulting services. Early warning systems with predictive analytics capabilities allow administrators and student retention specialists to effectively connect with students, assist them in developing a plan for success, and intervene when necessary and in the most effective ways.

Predictive analytics software can anticipate issues before they happen, allowing student success coaches to flag at-risk students and begin activating interventions. Predictive analytics leverages historical student data to determine which students need assistance and what challenges they might face on their path to success.

The software harvests this data from campus-wide systems, ranging from basic geography and demographics to more actionable academic ability, performance, and behavioral features, that can indicate when a student might be losing momentum. These systems may also use sensitive “ability to pay” and “financial support” insights gleaned from the FAFSA to help explain why some students may experience financial hurdles as they seek to complete their degree.

While learning institutions usually use the information gathered from the FAFSA in the early stages of a relationship with a student, such as when preparing financial aid packaging, FAFSA data can also impact an institution’s ability to meet students’ needs during later stages of their academic careers.

Another way learning institutions can help guide students through the financial aid process is through student engagement — actively reminding students of the importance of filling out the FAFSA form. Student reminders are especially crucial in community colleges, where fewer than one-third of first-time students complete an associate degree within three years.

Community colleges increasingly have a nontraditional student population — older students, minorities, and low-income students — who may have financial burdens that prohibit them from degree achievement without support. Providing additional support options and engaging with students early can help you identify and eliminate barriers to academic success.

For example, one-on-one consultations give student retention specialists a chance to identify and recommend specific resources for accessing and applying for student aid.

Early warning systems, predictive analytics, and student engagement programs deliver real results — since 2017, community colleges that have partnered with Watermark have seen the following improvements:

By partnering with Watermark, higher learning institutions have increased student access to financial aid programs, significantly improving outcomes.

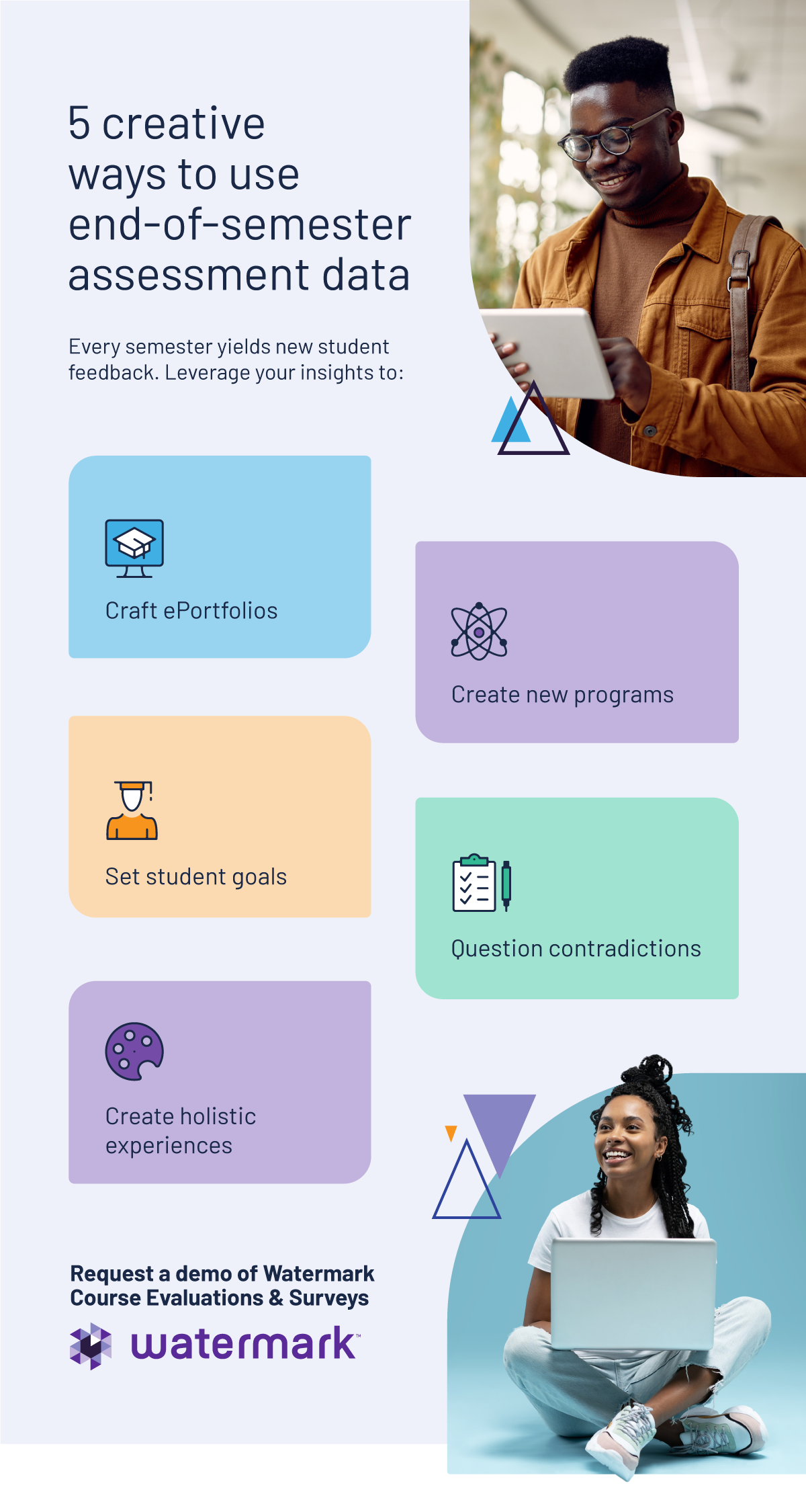

Student engagement is crucial for overall student achievement, and Watermark’s fully integrated suite of data collection, measurement, and analysis tools can help your institution reach the students who need the most support.

Watermark Student Success & Engagement provides you with valuable insights for keeping underserved students engaged, increasing retention rates and optimizing their chances of degree completion.

Get started today by requesting a free demo tailored to your institution’s needs.