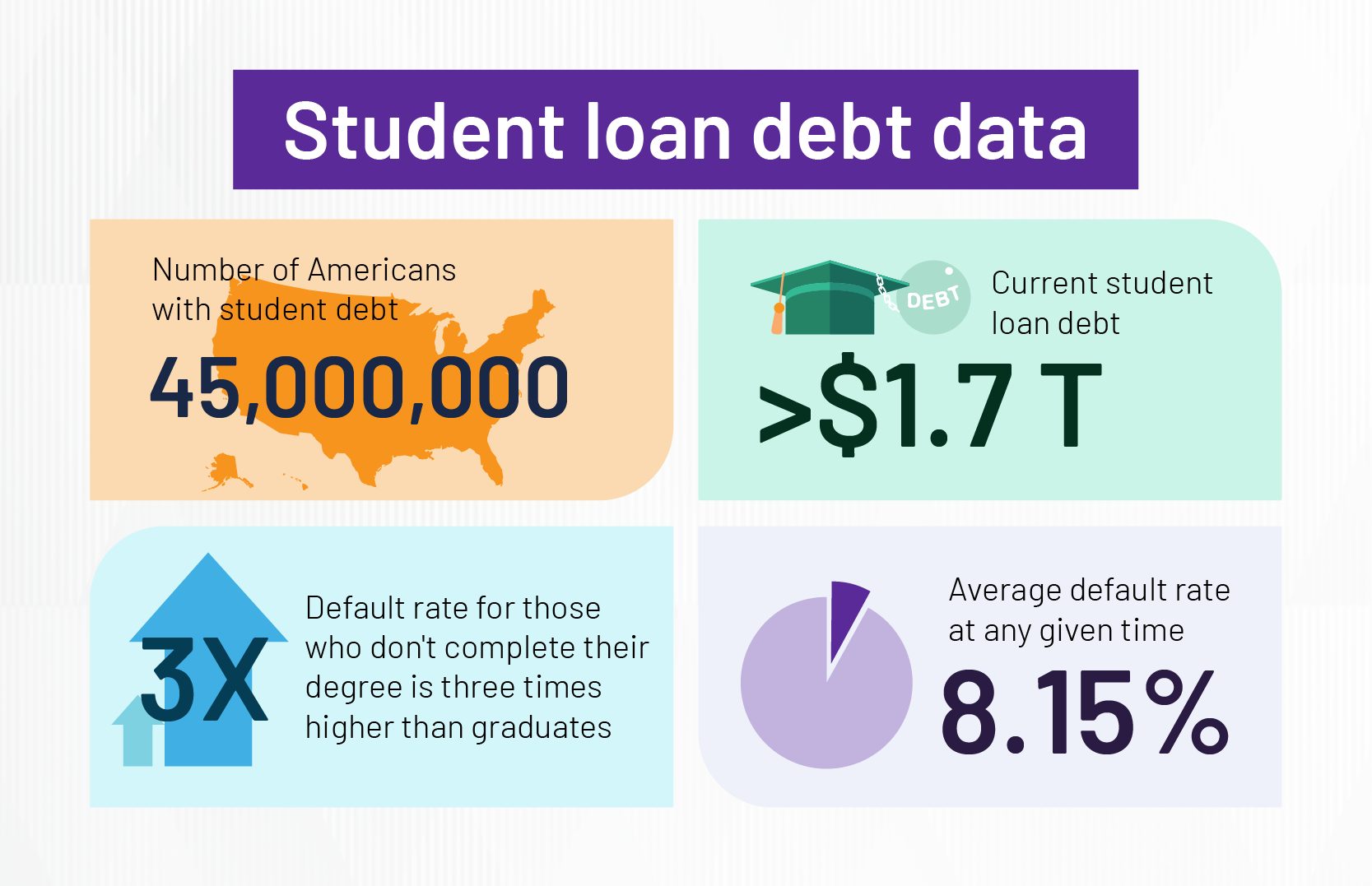

It’s no secret that higher education is more expensive than ever. According to the Education Data Initiative, the annual cost of tuition has risen 12 percent on average since 2010.

The reason behind this dramatic increase? A lack of ability to contain costs at the institutional level. This in-depth guide will explore how to contain costs in higher ed and why it matters for your institution, your students, and your community as a whole.

Understanding cost containment

Cost containment, in its simplest form, involves keeping expenses as low as possible to optimize profits without risking long-term damage to the institution.

Here’s what we mean. Let’s say you notice your institution’s water bills are significantly higher than they need to be to remain sustainable. A containment strategy to solve this issue might involve installing more efficient shower heads in dorms, replacing your toilets with water-saving ones, and finding ways to recycle water in campus buildings.

Every higher education institution has three levels of costs to consider:

- Student: Student-facing expenses, such as tuition, dining, textbooks, and housing

- Institution: Costs that fuel everyday operations within an institution, such as employee salaries, accreditation activities, and campus maintenance

- Societal: How social perceptions and community support impact the university’s expenses, such as changes in government subsidies or funding from new donors

Although the driving forces behind many of these costs are fairly obvious, many are impossible to control past a certain point.

The difference between price and cost

To properly examine the topic at hand, we should first distinguish between price and cost in higher education.

Let’s compare the two:

- Cost: What a college or university must pay to make its educational services possible.

- Price: What the institution charges for those services. The price of attending an institution must be high enough to make a return without making higher education inaccessible to students and their families.

Cost and price are interrelated — as costs rise, so too do the prices an institution must charge its students. Keeping costs low for the institution, then, benefits your students and improves your reputation as an affordable option.

The benefits of making cost containment an institutional focus

Proving your financial stability is an essential part of demonstrating institutional effectiveness to your key stakeholders — after all, they need to know they’re investing their time and money into an institution that can keep itself afloat.

Not to mention, keeping costs low makes it more possible to maximize financial and career-focused measures of student success, such as loan repayment rates and future employment.

Some other key cost containment benefits for higher education institutions include:

- More effective investments: If your institution has relied on the same vendors for a number of years, you may be spending more than you need to. Reevaluating your expenses may help you find vendors whose pricing better fits your institution’s budgetary needs.

- Greater operational efficiency: Cost-control management helps you clearly identify which activities run smoothly and remain within budget. With this information, you can focus on streamlining the areas where processes tend to be inefficient and unnecessarily expensive without impacting the functioning systems.

- Streamlined systems: Taking a good, hard look at your institutional infrastructure can help you identify bloat within your systems. Eliminating these areas of unnecessary spending will reduce costs and remove inefficiencies at all levels.

Cost drivers in higher education

To understand the factors that push higher education cost spikes, we need to evaluate what influences costs at every level of a higher education institution.

It’s important to note that many of these factors fall under more than one category.

1. Student cost drivers

Rising tuition and the overall cost of attendance make it increasingly difficult for students of all socioeconomic backgrounds to afford higher education — even with generous financial aid awards. Some of the factors that influence these high costs include:

- Support systems: Increasingly diverse student needs require broader, more costly support systems from institutions. For example, renovating campus facilities and updating digital resources to comply with the Americans With Disabilities Act (ADA) can cost institutions hundreds of thousands of dollars.

- Financial aid: For many students, higher education is inaccessible without a loan or scholarship. The issue is that, since financial aid budgets come from tuition revenue, awarding more financial aid naturally drives tuition prices up.

- Student expectations: Today’s prospective students and their families expect institutions to provide state-of-the art research facilities, full course catalogs, modern amenities, and plenty of student support services. However, many institutions struggle to keep these services funded with the budgets they’re allowed.

- Increased competition: An ever-shrinking pool of traditional college students means institutions must funnel more funding into marketing and prospective student communications — and these costs remain long after the students have left.

- Lower enrollment: Domestic and international enrollment has been low for several years now, though 2023’s numbers are a slight improvement from the previous year. And it’s about to get worse — the U.S. is facing an enrollment cliff beginning in 2025, where fewer traditional college students will be applying than in several decades.

2. Institutional cost drivers

At the institutional level, cost drivers tend to be associated with the operations required to meet student and societal expectations.

Some of those costs include:

- Compliance and accreditation: Higher ed is subject to more compliance requirements than ever before, and maintaining accreditation status with a steadily growing number of accreditation bodies causes associated costs to continue rising.

- Digital sprawl: Many institutions invest in disparate software tools to address isolated issues, which creates a disjointed data ecosystem that creates data silos and process inefficiencies. And as an institution adds tools to its tech stack, its annual IT spend increases year over year.

- Administrative bloat: As compliance requirements and student expectations have become stricter, institutions have begun hiring more administrative staff to handle those regulations and provide more services.

- Tech upgrades: The constant cycle of software upgrades and updates requires frequent staff and faculty training sessions, which can become costly due to the amount of time spent.

- Rising salaries: Increasing salaries and benefits packages to match rising costs of living means your institution’s expenses are growing faster than revenue. The irony is that in recent years, most faculty salaries have remained steady while spending rose in administrative departments like admissions and registration.

- Debt capacity: Some institutions are reaching the limits of their debt capacity and must tap into their endowments to keep underfunded services up and running.

3. Societal cost drivers

The final drivers of education costs are based in societal perceptions and expectations for higher ed, which can significantly impact the approach your institution needs to take to funding specific programs and activities.

These factors usually come from outside the institution and can include:

- Changing economic climate: Inflation and other economic crises can make it challenging for institutions to continue providing the same level of services and education without raising prices

- Reduced government support: At some public institutions, state subsidies have shrunk over the years. And less government funding means the educational institutions must take on more expenses.

- Donations and sponsorship: According to data from the Journal of Higher Education Policy and Management, higher education institutions have seen less revenue from individual donors over the past few years due to changes to the U.S. tax code.

Budgeting strategies for higher education institutions

The most important step in containing costs at your institution is to build an actionable strategic plan for doing so. And the keyword here is actionable — you need your plan to be something you can reasonably accomplish. An example of such a plan consists of three components:

- Actionable: You should have a clear vision for how you will set your plan into motion in order to begin working toward the improvements you need to make.

- Achievable: A realistic, attainable goal is essential for making real improvements on your budget.

- Data-driven: Basing your spending decisions on reliable historical and current data can help you improve the chances that your actions will have the desired effects.

There are many different potential shapes this plan can take. Higher education institutions usually follow one of six budgeting models.

1. Incremental

In this traditional approach, the institution bases budget proposals and funding allocations on records from the previous year. Only new revenues are allocated, saving administrators valuable time in evaluating expenditures.

Although this method has been popular for many years, it’s limited in scope and provides little room for innovation. There is little room for financing new additions to the budget, which can prevent institutions from investing in new initiatives that can boost competitiveness and academic rigor.

There’s also the issue of institutional units stretching their budget allocations to get more funding in future periods. Agencies have a tendency to award more funding to programs and departments that spent most of their budgets in previous years.

For example, let’s say you allocate the same amount of funds to your engineering program and your physics department. Each department takes a wildly different approach to budgeting, with physics opting for the latest, most advanced materials and engineering being more conservative with their spending.

When at the end of the year you find that engineering only spent 75 percent of their budget and physics spent 99.5 percent of theirs, you might instinctively make the decision to award more to physics and less to engineering — even if the reason behind the discrepancy belies each department’s actual need.

As a result, many forward-thinking administrators are moving away from this model toward more dynamic ones, such as zero-based and RCM budgeting.

2. Zero-based

In this budgeting model, each new fiscal year starts off with a totally blank slate — a “zero base.” Without a litany of legacy expenses to influence your planning, your budgeting team must carefully think about where each dollar will go, which can help you trim most of the fat.

Although this method can help you avoid unnecessary spending, implementing a zero-based budget is often a time-consuming process. All institutional entities must re-request and re-justify funding for each activity before adding it to the budget, even in the case of old and recurring expenses.

Additionally, zero-based budgeting can skew your budgeting plans in favor of short-term growth rather than long-term investments. Rather than considering what costs will help your institution grow year after year, it’s a significant risk to limit your considerations to only what will help you for the next academic term or quarter.

3. Activity-based

Activity-based budgeting is a bottom-up budgeting approach that aims to provide insight into spending patterns for each activity or project in your institution.

The advantages of activity-based budgeting include:

- Greater efficiency: Basing your budget on real-time data analyses helps you make informed decisions faster, which streamlines the budgeting process.

- Higher returns: When you allocate more funding to the activities you know will help you increase revenues, your institution benefits from having more cash available for continuous improvement. In for-profit institutions, this translates into stronger profit margins year over year.

- Easier review: With your budgeting data infrastructure in place, it’s easier to go back and evaluate how each activity performs during the budgeting period. You can use this tool to hold institutional entities accountable and track their progress throughout each fiscal year, which streamlines budgeting for the next year.

Your budgeting teams will need to spend a significant amount of time and energy on the groundwork to implement this system — and investing in a robust data management and analytics system is critical for pulling and extracting insights from your institutional data.

Accurate data and efficient analyses are especially important for making strong returns using this budgeting model.

4. Responsibility Center Management (RCM)

RCM budgeting is a model that puts each revenue-generating unit in charge of managing its own revenues and expenditures. For example, your athletics department would independently manage all its budgeting allocations for the academic year rather than relying on a plan set by the administration.

The advantages of the RCM budgeting strategy include:

- Increased transparency: Using the RCM model, you can better align your institution’s strategic goals with clear, understandable allocation methodologies that you can easily audit.

- Greater motivation for returns: Giving each unit authority over its budget incentivizes academic entrepreneurship — unlike with incremental budgeting, RCM motivates academic units to pursue new opportunities for revenue beyond their existing operations.

- Data-driven budgeting: Each unit must refer to institutional data to make informed decisions regarding which activities to fund and which to cut, which can help reduce unnecessary spending.

The potential drawback to RCM, though, is that failing to properly plan can cause inefficiencies within units.

5. Centralized

Contrary to its name, the centralized budgeting model uses both centralized and decentralized budgeting practices to keep costs low. The upper-level administration maintains all decision-making power, which enables your institution to pursue a clear, unified vision.

The top-down model also allows for high flexibility in decision-making, which can help protect you from losing revenue to unaddressed legacy expenses.

However, a top-down model can eliminate internal competition and, potentially, demotivate individual units from pursuing their own strategies. Allowing an extra degree of autonomy can help you avoid this issue, but it must be carefully planned.

6. Performance-based

In a performance-based budgeting system, your institution allocates funds based on how well each unit meets a predefined set of outcomes and standards.

Essentially, it measures the input of resources against the output of services for each department and unit within your institution. This way, each division has the motivation to optimize their funding allocations to provide the most value possible.

Some potential performance targets you could aim for include:

- Higher student retention rates

- Improved graduation rates

- Increased enrollment yield year over year

Although this model promotes transparency and accountability within your institution, the review process is long and inefficient. Like with activity-based and zero-based budgeting, you need to go through each unit individually to determine its value and whether it justifies your investment.

Additionally, because it’s a decentralized budgeting method, it makes establishing a unified vision more challenging than it needs to be.

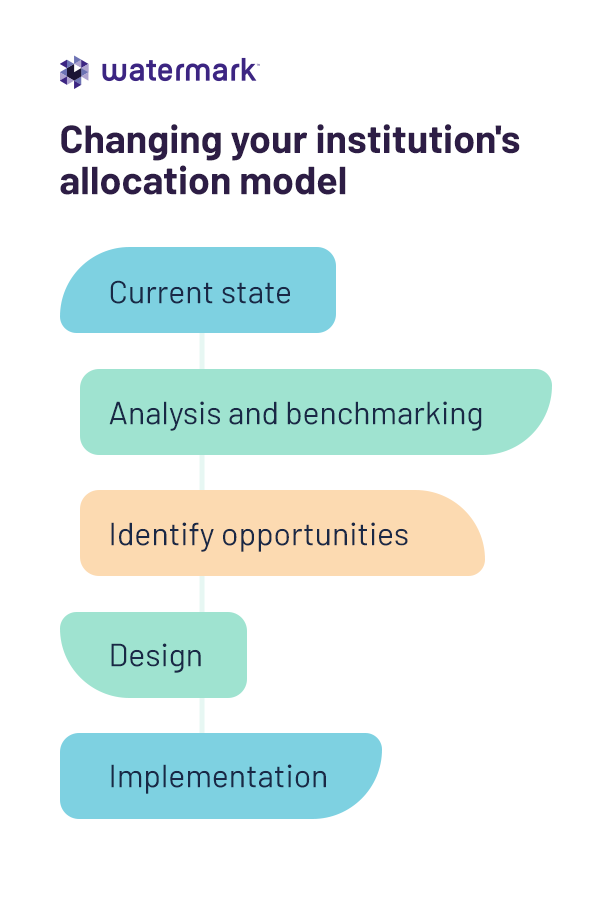

Changing your institution’s allocation model

If your institution determines it makes sense to implement a different budgeting model, the following steps are important for a successful transition:

- Current state: Gather data on your existing allocation processes and outcomes over a predefined period of time. Investing in a robust centralized data infrastructure is critical here, because it will make generating insights from your data much easier.

- Analysis and benchmarking: Once your data collection period has ended, it’s time to determine what that data says. Open datasets from competing institutions or historical data from previous periods can serve as effective benchmarks for determining how well your institution is doing.

- Identify opportunities: Examine your data for trends — where are you spending the most, and how are those funds being allocated? These discoveries will help you pinpoint your opportunities for cost savings in the future.

- Design: In this stage, you design the system that works best for your institution. Whether you choose one of the existing budgeting models or you create a hybrid of two or more, it’s important to ensure that your system will cover all the entities within your school.

- Implementation: Now that you have your plan ready and a system in place to accomplish it, it’s time to implement that plan. Change management policies and a designated implementation team can help make this process as smooth as possible.

Cost containment strategies in higher ed

Institutions can make many different choices in containing costs. Here are some cost containment examples you might consider implementing in your plan.

1. Eliminating your spending pitfalls

First, it’s important to determine where your institution loses funds. Fortunately, you can do this with data your institution already collects.

Some common examples include:

- Rushed hiring: Filling open positions right away can be more expensive than you may imagine. At many institutions, it’s more cost-effective to hire part-time or adjunct faculty and staff until the budget has more room.

- Misusing temporary funding: It’s important to keep short-term and long-term funding sources separate, as making long-term commitments on short-term dollars can lead to unfinished projects and unexpected costs.

- Enrollment gaps: Although enrollment has increased slightly since the pandemic, a disconnect between academic budgets and enrollment numbers can cause certain departments to get more or less funding than they need.

Aligning your institution’s academic offerings to reflect evolving enrollment trends will help you stay competitive.

For example, short-term credentials at community colleges and four-year for-profit institutions saw the highest enrollment numbers in recent years, while full degree programs at every level only saw slight growth.

2. Adapting your budgeting strategy

While most institutions still use an incremental budgeting strategy to set their expenses for each fiscal year, many are becoming aware of this method’s limitations.

Switching to a less conventional budgeting model could help you streamline funding reviews and adapt to the rapidly evolving tech landscape. Your institutional data from all sources — faculty, students, non-academic units, and more — will help you determine which model is the best fit.

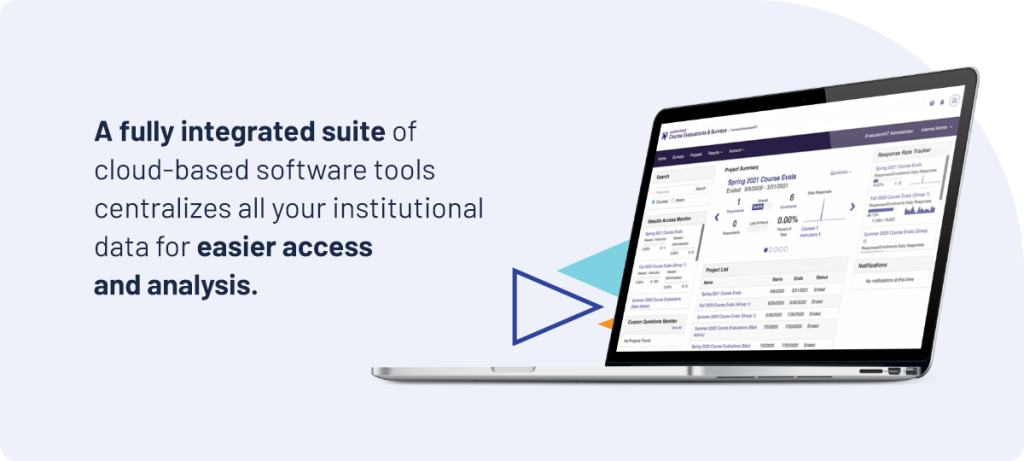

3. Consolidating your tech stack

The more software tools your institution uses, the more you’ll spend on maintaining your licenses and training your staff. Instead of purchasing an individual solution for each task you want to accomplish, you can cut costs and save valuable time by investing in one comprehensive solution.

A fully integrated suite of cloud-based software tools centralizes all your institutional data for easier access and analysis, so you can generate on-demand insights from anywhere, at any time.

Plus, by providing a digital space to store and manage all your data, you can save on paper systems and processes. Simplify student portfolio organization, or streamline accreditation preparation, all from one fully integrated location.

4. Automating repetitive processes

Investing in the right education technology (edtech) tools is a key component of implementing successful cost containment measures at your institution.

Automated technologies cut costs by eliminating duplicate work and reducing the risk of human error in tedious tasks. For example, tasks like payroll and manual data entry are highly susceptible to errors due to their repetitive nature — and allowing a mistake to remain in the system can be costly. Automation eliminates this risk and adds value by freeing up your staff to focus on more high-level responsibilities.

Intelligent automation powered by artificial intelligence can also help you contain costs by enhancing your student retention efforts. Predictive analytics can proactively identify students who are at risk of dropping out by analyzing behavioral data, and an automated student success program can send an alert to support staff so they can help the student get back on track.

5. Outsourcing or cosourcing certain operations

Traditionally, higher education institutions outsource auxiliary operations such as dining services, vending, housing, campus bookstores, and landscaping. But, depending on your institution’s size and organizational structure, you may be able to further cut costs by outsourcing or co-sourcing core services like IT and financial aid.

Here’s why. Outsourcing allows your institution to take advantage of economies of scale from service providers that you wouldn’t be able to do by hiring your own staff to do the same tasks. It also gives you access to resources and expertise you may not have access to otherwise.

6. Adjusting programs and course offerings

Many institutions have begun cutting courses and programs that lack the interest needed to justify their costs. Although choosing to drop certain offerings can be disappointing for students, it’s often necessary to keep your institution afloat.

Look for programs with declining enrollment numbers and rising costs. The resources allocated to these programs likely are not proportional to their outcomes and could be put toward more profitable programs.

A curriculum mapping tool can help you understand which courses and programs produce the most value for your students and your institution. This tool can help you clearly connect outcomes to courses and specific points in curricula, so you can easily evaluate whether that course is meeting your requirements.

7. Evaluating staffing needs vs. current expenses

It makes sense to increase salaries and benefits as the cost of living rises. But labor is one of the biggest cost drivers in higher education for those reasons.

When it comes to faculty, many institutions choose to hire part-time or adjunct professors rather than retaining full-time, tenure-track faculty. Although this arrangement can reduce your labor budget, it has drawn criticism for the fact that many adjuncts struggle to make ends meet without additional assistance.

An alternative solution, then, is to increase the number of hours tenured faculty members spend in the classroom. The longer your faculty spend instructing students, the more value they are providing your institution — which helps maximize labor-related costs.

The cost containment process explained

Here’s a brief overview of what the typical cost containment process looks like.

1. Create a planning and budgeting team

Creating a dedicated team for budget and cost containment activities is important for facilitating productive financial discussions.

The parties you should bring in to create your budget will vary depending on several factors, including your institution’s size and business model. Generally, though, it’s a good idea to comprise a team of:

- Administration: Your institution’s president, provost, chancellor, and any other administration members heading non-academic units

- Deans: All members of your institution’s council of deans

- Faculty: Heads of departments and programs as well as senior faculty

- Trustees and donors: External stakeholders such as your board of trustees and private donors

Asking students and institution staff for their input can help you make sure you’re covering all your institution’s funding needs.

2. Benchmark and analyze

Next, it’s time to set your institution up to track progress. Where are you now, and where are you trying to go? Achieving your goals is significantly easier when you can measure your success, as it gives you a way to hold yourself accountable.

Establishing benchmarks is the first step. Open datasets from your competitors can serve as excellent benchmarks for typical costs in specific departments and programs, or you can use your own historical data.

3. Strategize

Now that you have a good idea of the distance between your current circumstances and your goals, you can determine which cost containment strategies would work best for your institution.

For example, if your analysis reveals that your institution wastes an excessive amount of food every month, you might choose to switch to a more cost-effective dining services vendor to reduce costs for both the institution and your students. During this phase, you’ll evaluate different vendors to make sure you find the right fit, then sign an agreement in the next step.

4. Implement and track

Finally, it’s time to put your plan into action. Throughout the budget period, your team should track key performance metrics to ensure your cost containment measures are having the intended effect.

For example, if you choose to reduce costs by outsourcing IT support, you could track the number of resolved tickets in a semester and compare it to the cost per ticket.

You may be able to see trends appearing throughout the budget period. However, for most strategies you’ll see the biggest differences at the end of the year because they will have had enough time to take effect.

5. Review and rework

At the end of your fiscal year or academic term, regroup and review how well your budget worked for the period. Did you need additional funding in any areas? Were you effectively able to cut costs in the areas you identified?

Apply your discoveries to budgeting discussions for the next term. This step is essential for closing the feedback loop and achieving real continuous improvement.

Investing in technology: A path to cost containment

It may sound counterintuitive, but investing in tools that allow you to consolidate your institutional tech stack without losing functionality is essential for reducing costs.

Ideally, your software tool will fully integrate with all the other applications your university uses to create a single, unified solution. Seamless data transfer between applications means you can save valuable time looking for information, and real-time analysis features enable total transparency into what’s happening in every level of your institution.

Leveraging data for cost containment

The data-driven organization is a crucial concept for higher education institutions looking to remain competitive in the digital age. Basing all financial, academic, and leadership decisions on concrete data helps improve institutional effectiveness and save costs — as long as you know how to use that data.

Your data is useless until you can extract value from it. Knowing what data to collect as well as how to analyze and present it is essential for effective cost containment projects.

Collecting the right data

The first step toward making budget improvements is to gather relevant data concerning your expenses and revenue streams.

Even though your institution may already be collecting the data you need, storing it in many different places can negate its value.

That’s where the concept of data convergence in higher ed comes in. Data convergence is the process of centralizing all an institution’s data into one unified, cloud-based system — so anyone who needs to access your data for informed decision-making can do so from any location or device.

Maintaining good data quality

Consolidating your institutional data reduces the number of applications institutions need to manage and maintain, which cuts technology costs. But it can also improve data governance operations, eliminating errors and other issues that can result in accidental cost overruns.

Here’s how. Digital convergence using a robust centralized system simplifies data governance tasks and increases visibility by eliminating data silos — the blind spots that appear when each group uses a separate system to store and manage their information.

By removing these blind spots, the institution becomes more unified, which makes analyzing the data for cost control significantly more efficient.

Generating insights for powerful decision-making

Your institution needs the proper infrastructure to support data storage and analysis at scale. That’s where a unified data analytics and management system designed specifically for higher education comes in handy.

A tool that provides rich visualizations and interactive dashboards illustrates the full narrative behind your data for all stakeholders. You can save valuable time by eliminating the need for complex data science operations simply by providing more accessible reports.

How embracing technology contributes to sustainable institutional financial health

Advanced data analytics is the best tool for cutting costs effectively in your institution. And investing in a robust, comprehensive data storage and management solution is they key to unlocking the power of those insights.

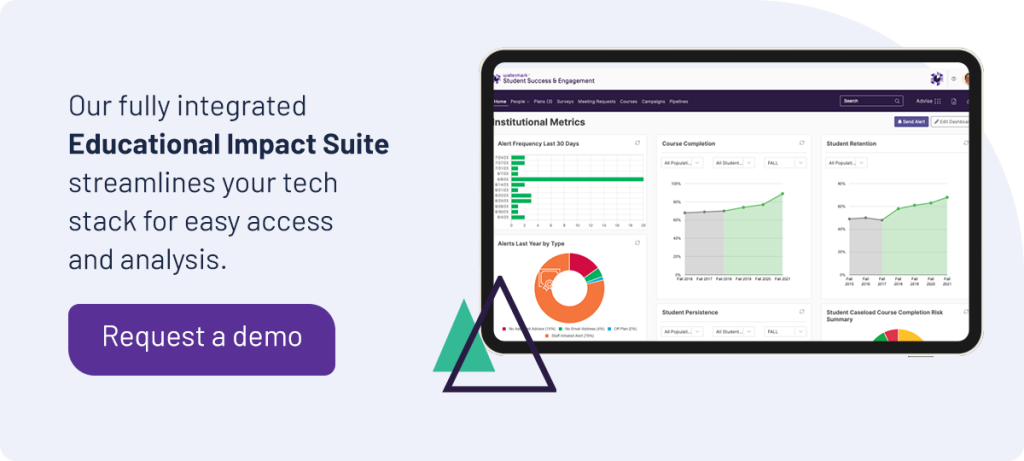

At Watermark, we’re committed to helping higher education institutions harness the power of data. Watermark’s fully integrated Educational Impact Suite (EIS) streamlines your tech stack by pulling data from all areas of your institution into our centralized Insights Hub for easy access and analysis.

On-demand analytics functionality unlocks complete, real-time visibility into your institution’s data, so you can compare historical and current budgeting trends and track improvements year over year. Plus, rich visualizations and user-friendly dashboards make it easy for stakeholders to understand those insights regardless of their experience with data analytics.

Maximize your institution’s budget with solutions from Watermark. Get started with us today by requesting a free, personalized demo.